Many insurance companies and startups go with a mobile app that makes cooperation with clients more user-friendly and transparent. The mobile application is a superb tool for handling tasks, reminders and insurance-related alerts. The app allows not just to take care of only health but also useful in difficult situations. The client can check the insurance plan on their smartphone or tablet.

The market researcher knows the importance of a mobile app. The mobile app of insurance companies will help customers understand all the insurance points and also get in contact with the organization or particular customers.

The insurance mobile app development introduce such features as integration with social networks, banks, ticket offices, tour operators, airlines, hotel reservations, and any other organizations or companies. Users' satisfaction should be an increase or rather than utilizing different software. One thing should keep in mind, the more function is implemented, the more insurance app development price will be.

What is on demand mobile insurance app

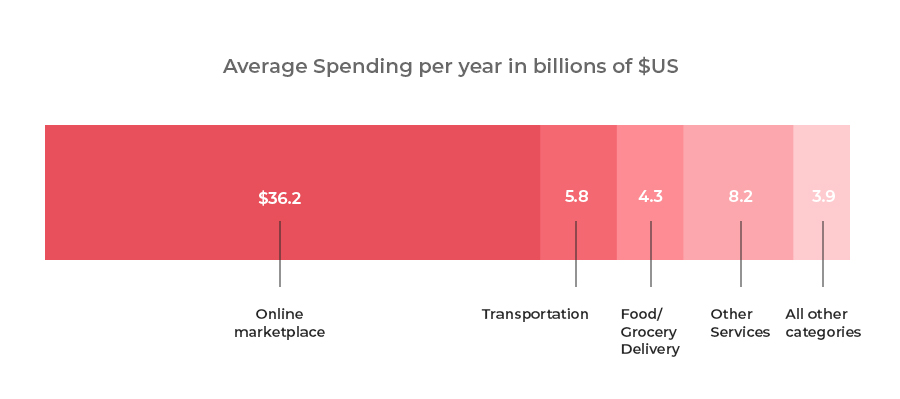

As in-built service app allow the user to order a product or service & get it delivered literally to their doorstep, ride, meal, house-cleaning assistance, or anything else you can think of. It is a link between users and their needs, a connection via the mobile app. In reality, there are more elements than a mobile app connecting users to products and services.

As in-built service app allow the user to order a product or service & get it delivered literally to their doorstep, ride, meal, house-cleaning assistance, or anything else you can think of. It is a link between users and their needs, a connection via the mobile app. In reality, there are more elements than a mobile app connecting users to products and services.

Also read: On Demand Fuel & Gas Delivery App Development

Insurance app development benefits

Immediate Access

With the on-demand app, User can take a service virtually from anywhere with a couple of taps. And it is one of the big benefits of these insurance apps.

In-App Payments

Users can pay for goods and services using a credit card right card from a mobile app. Apple and Google making an app that is available to all the people. On-demand apps have also raised the question of just how the company should invest on-demand app development to get a decent looking of an app.

Insurance companies are now joining the trend; mobile apps are appearing more today than a couple of years back.

Why your compnay need insurance mobile app

- One good reason to make an insurance mobile app to reach new customer but if you want some more specific motives then can offer to the newly or all the customers.

- There is no gap between a company and customers; it’s quicker, smoother and more effective. It is responsible to acquire new clients by advertising your app on other apps.

- More opportunities to collect and process information.

- A well-rounded app lowers operational costs and increases revenue for an insurance company.

How to create your own insurance app

Insurance businesses are pretty crafty related to mobile applications. Insurance is a business with three main actors- the insurer (or insurance company), the insured (the person buying the insurance) and suppliers of services covered by the insurance carrier. For health insurance, consult with the physicians and hospitals. For car insurance, it would be car repair services.

Each factor, the insurance circle will require of their own app. Even you can build an insurance policy app for everybody where do register, an individual will choose a role. Deciding on a role is one more step in the enrollment procedure.

A combo app will be approximately three times as big as other apps but it'll demand more space on a mobile device, need more processing power & more funds. But should keep in mind nobody likes heavy apps. You may want to sacrifice performance to maintain your app; you can add more features to each app without making the heavy app.

If you are planning to create an insurance mobile app, you should aware of these 3 points. If you don’t want to build 3 apps, you can actually build two one for clients and another to your workers. By creating a separate app for service suppliers, indirectly you're reducing the cost of app development.

Also read: e-Scooter Mobile App Development, Tme, Cost & More

Types of mobile insurance apps

People today insure all types of things, a number of them funny and even pretty weird. Here is that mobile apps will fluctuate based on the market insurance company operates in.

People today insure all types of things, a number of them funny and even pretty weird. Here is that mobile apps will fluctuate based on the market insurance company operates in.

- Health insurance app

- Travel insurance app

- Auto insurance app

- Life insurance app

- Enterprises insurance app

You'll have to implement, depend on your type of insurance business. At the same time, whatever the function of the insurance business in, life, health, property, or car insurance, etc. the basic set of attributes in a mobile app will be similar. Niche-specific features will include, but the core Process will be the same.

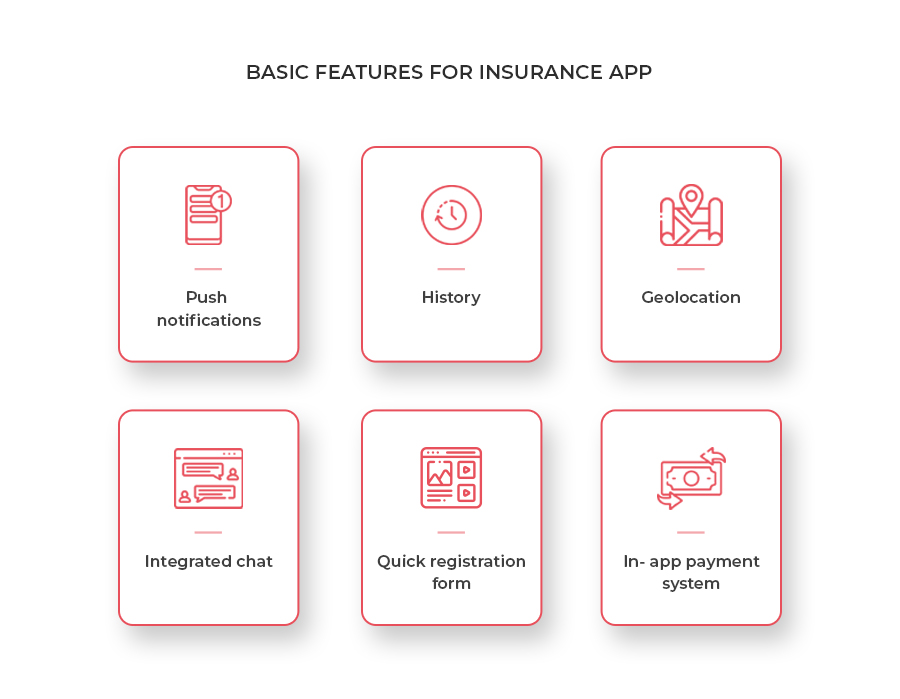

Features of insurance app development

Profile

Profile

A profile is a display where information about the thing or person is available. If there's a life or health insurance app, a profile will reveal information about the insured individual, if it's a car insurance apps, automobile data will be shown on the profile display together with basic data about the owner.

Cover the area

An electronic version should be available in the app. Clients should be able to test it whenever they need, whether you allow customers to choose a new policy or switch from an old one without seeing your company's office, it's important to offer clients a chance to navigate all choices at a convenient time.

Also read: Matrimonial App Development, Time, Cost & More

Benefits of the insurance app for user

In Reality, there are lots of reasons but we will focus on a few main factors.

- A simple drawing of insurance functions.

- A client needs to make a few clicks in order to get insurance through a mobile application.

- The person doesn’t have that much time and sees the insurance company to consult an issue of interest. Therefore, People appreciate various insurance app features such as online chat, feedback, etc.

Notifications

The App will not allow the customer to forget about the end of the insurance plan. It'll notify him of discounts and promotions also on a daily basis or monthly basis.

Suitable data storage

As a result of the wise insurance apps, all the necessary information is stored in one interface.

Getting information quickly

A client is able to learn everything about your business in minutes. Apart from that, he'll locate your nearest office on the map; if you still face the query then you can discuss in the office as well.

Determination of place

The reallocation functions provided by the insurance policy app for iOS and Android can assist the user with the broker.

Thorough and timely directions

The customer can instantly get advice on the activities that he was requested.So, now hope you understand the customers' benefits and it's time to consider the digital world effects.

if you're a looking for insurance mobile app development for your compnay then you can get in touch or request for free quote.